Unpack the dynamics of India’s stock market on July 10, 2025. Discover key movements in Sensex, Nifty, and top stocks, along with expert insights for investors.

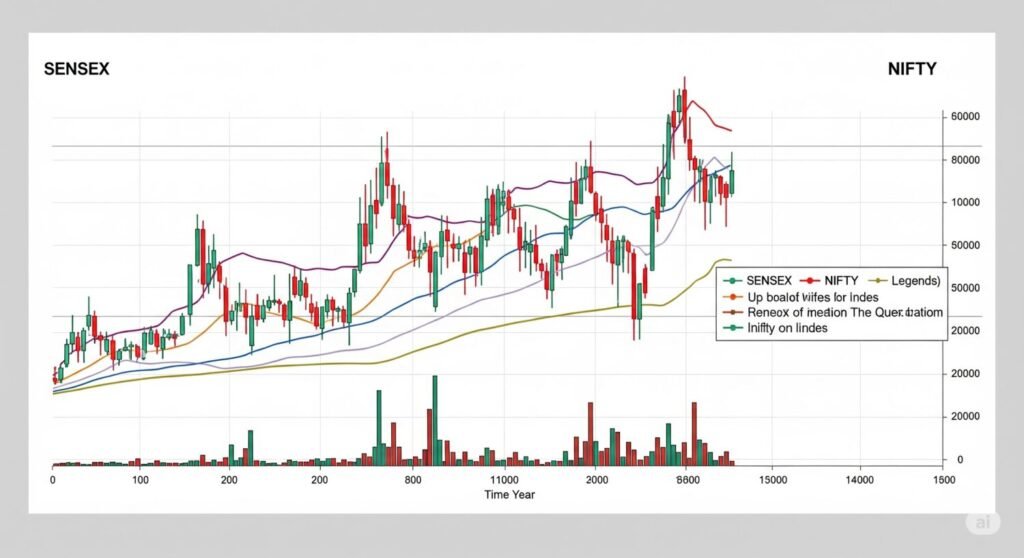

The Indian stock market witnessed a day of cautious trading on July 10, 2025, as benchmark indices closed lower amidst mixed global signals and specific sectoral pressures. Investors closely watched domestic corporate results and international trade developments, shaping the day’s narrative for Sensex and Nifty.

Market Snapshot: A Day of Dips and Resilience

The broader market saw the Sensex shedding 346 points, closing below key levels, while the Nifty slipped just under the 25,400 mark. This downward movement was largely influenced by notable corrections in heavyweight stocks. Telecom giant Airtel saw a significant drop of 3%, and Asian Paints also dipped by 2%, contributing to the overall decline. Despite these pressures, the market showed underlying resilience in certain segments.

Sectoral Shifts: IT’s Pullback and Broader Market Performance

The IT sector emerged as a primary drag on the market, with the Nifty IT index leading the losses. Major players like Wipro and Infosys experienced declines, reflecting global tech sector headwinds. Conversely, the broader market painted a slightly different picture. Midcap and Smallcap indices managed to register modest gains, indicating a continued appetite for growth opportunities outside the large-cap space. Other sectors like Auto, Pharma, and FMCG also opened lower, adding to the overall subdued sentiment.

Key Corporate Highlights and Market Buzz

Several corporate announcements captured investor attention:

- Tata Elxsi: The company reported a 22% year-on-year plunge in its Q1 net profit, with revenue also declining by 3.7%, attributed to macroeconomic challenges.

- TCS: A leading IT behemoth, TCS declared an interim dividend of ₹11 per share and announced a 6% rise in its consolidated net profit for Q1FY26, reaching ₹12,760 crore, a positive signal for its investors.

- Orient Cables (India): The market saw new activity with Orient Cables (India) filing for a substantial ₹700 crore Initial Public Offering (IPO), signaling expansion plans.

- Mutual Funds: For those looking to diversify, 17 new mutual fund offers (NFOs) are currently open for subscription, providing fresh avenues for investment.

- Tesla: Internationally, Tesla announced its annual shareholder meeting for November 6, amid heightened investor scrutiny following a 38% drop in its share price since December.

Global Cues: A Mixed Bag

International markets presented a mixed bag of signals, influencing local sentiment. While S&P 500 futures saw a decline and Japan’s Topix fell, other major Asian indices like Australia’s S&P/ASX 200, Hong Kong’s Hang Seng, and the Shanghai Composite registered gains. Euro Stoxx 50 futures also showed an uptick, suggesting a varied global economic landscape.

The market on July 10, 2025, underscored the ongoing interplay of domestic corporate performance, sectoral dynamics, and global economic factors. While large-cap indices faced headwinds from specific sectors and global uncertainties, the resilience in midcap and smallcap segments highlights the diverse opportunities available in the Indian equity market. Investors are advised to stay informed and agile in response to these evolving market conditions.